Complex enterprise sales isn’t about delivering the slickest demo or having the lowest price. It’s about people. People with competing agendas, personal ambitions, and informal networks that rarely show up on the org chart.

If you’ve been in the field long enough, you’ve lived this. You’ve had a “champion” who assured you that they were the decision maker — only to discover the real decision was made three levels up, influenced by someone you’ never met. Or you’ve been blindsided by a detractor who torpedoed the deal after months of development and progress.

I’ve been there too. And the painful lesson I’ve learned is this: you can’t win complex opportunities if you don’t understand the web of influence that surrounds them.

The influence map brings clarity to this complex set of relationships. They’re not just a nice-to-have visual.

They’re a discipline — a way of bringing clarity to the chaos of enterprise decision making. I’ve been building influence maps as a key part of my account planning and opportunity development/review processes for many years.

And when combined with the Relationship Bank Account (RBA) and the Business Value Hypothesis, influence maps become more than tactical tools. They become the foundation for orchestrating deals with intention.

What Is an Influence Map?

An influence map is a visual representation of the power dynamics, alliances, and motivations in an account or opportunity.

It goes beyond the org chart:

Org chart = reporting lines

Influence map = how decisions actually get made

An influence map should tell you:

Who has budget authority (economic buyers)

Who owns technical approval (evaluators)

Who has hidden influence (trusted advisors)

Who advocates for you, who sits neutral, and who resists

What personal goals and fears shape each player’s behavior

In short: it’s the political map of your deal.

Why Influence Maps Matter

Complexity Demands Clarity

Enterprise opportunities often involve 6 – 10 stakeholders, sometimes more. Without a map, it’s guesswork. With a map, complexity becomes navigable.

Politics Are Real

Every company has both a formal structure and an informal one. Decisions rarely flow top-down in neat lines. They zigzag through friendships, alliances, and rivalries. Influence maps expose the truth.

Risk Lives in the Shadows

Most deals aren’t lost to competitors. They’re lost to no decision or a last-minute veto, usually based on perception of risk and whether they trust the sales person to deliver on their promises. Mapping neutral parties and detractors early lets you strategize before it’s too late.

Time Is Precious

You don’t have time to build relationships everywhere. Maps show where to double down —where deposits into the Relationship Bank Account will have the greatest impact.

Real World Experiences

At Oracle, my division built influence maps the old school way – talking them through while sketching them out on a white board, and then transferring them to PowerPoint for future reference. While this sometimes seemed time-intensive, the group input was incredibly valuable, with individual members of the team contributing from their own perspective and experience.

Occasionally team members would disagree on an individual’s role or the strength of the relationship, and the ensuing conversation would always prove valuable. We would generate many WWWs (Who/What/When action items) that would help to clarify our position and strength within the account.

In another case, I facilitated an account planning process for a team in another division which leveraged an online influence mapping tool, Revegy. After kicking off the session, I went to the white board to begin building the influence map. The team reminded me that they use Revegy and suggested that we simply pull up the existing map and review it.

I declined, suggesting that the interactive building of the map, however repetitive it might seem, typically provides new perspectives. Forty-five minutes later, after building a new influence map from scratch, we compared it to the version in Revegy, and to the surprise of the team, they were quite different.

The Relationship Bank Account Connection

Here’s where the RBA ties in. Every stakeholder on your influence map represents an account you hold with them. You make deposits — small gestures like remembering their birthday, forwarding an article, or connecting them with a peer. And sometimes you make withdrawals — asking for a reference, pushing for a meeting, requesting internal support.

An influence map shows you where to invest your deposits strategically. Advocates still need deposits to stay strong. Neutrals can often be moved with consistent deposits.

Detractors? Sometimes deposits help — but sometimes you need to stop investing there and redirect your energy elsewhere.

And the influence map contains both your rating of the current relationship and the direction it’s moving. This provides a comprehensive view Without an influence map, you’re making deposits randomly. With it, you can be intentional with your time and focus.

Building an Influence Map

Step 1: Start with the people you know

With a new influence map template begin adding people you know. Use LinkedIn, company sites and or intelligence tools to identify additional people and their reporting lines. This is your skeleton.

Ask other sales people to identify people and roles in previous deals and how they progressed.

Step 2: Identify Stakeholders

Include everyone who touches the decision — economic buyers, evaluators, procurement, legal, users, executives. Don’t forget “shadow influencers” who have no formal role but carry weight.

Step 3: Go Beyond Titles

Ask: Who actually sways decisions? Who has credibility? Who is risk-averse? Who has scars from a past vendor failure?

Step 4: Map Relationships

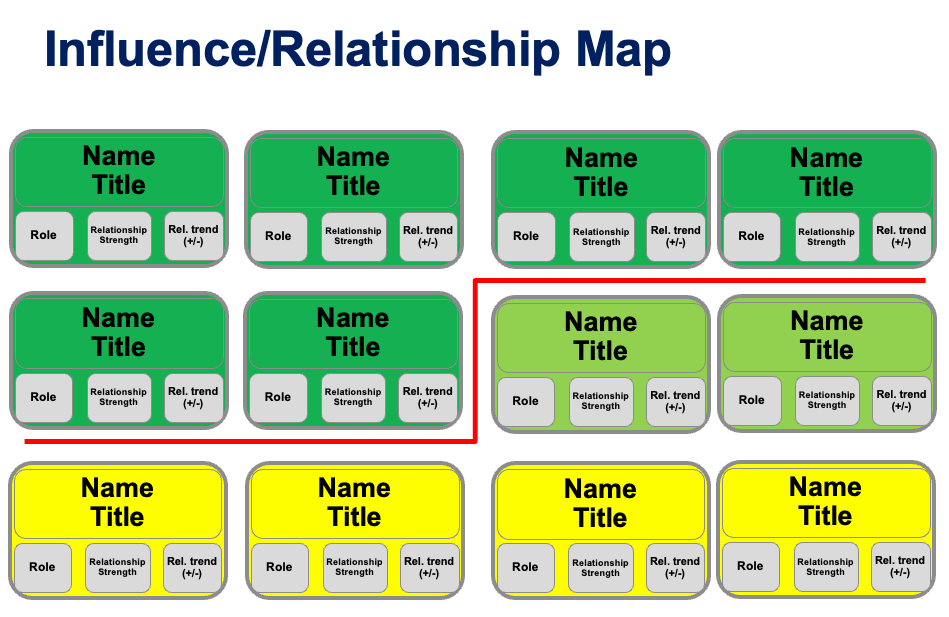

Use arrows or lines to show influence. Make some thicker for stronger pull. Add emotional indicators: green for advocates, yellow for neutral, red for detractors.

Step 5: Capture Motivations

Write notes on each person’s goals, fears, and career ambitions. “Wants visibility with CFO.” “Conservative, avoids risk.” “Aspiring VP, wants a win.” These details matter.

Step 6: Simplify Where Possible

In even the largest deals — even eight and nine figure ones — there’s no more than a handful of people above the line.

Using Influence Maps in Opportunity Development

Call Prep: Review the map before each meeting. What’s the goal with this person? What message will resonate?

Discovery: Gaps jump out. Haven’t met legal? Missing CFO perspective? The map shows where you’re blind

Multi-Threading: Avoid over-reliance on one contact. A healthy map shows coverage across functions and levels

Champion Validation: Influence maps test champions. Can they actually move the deal Or are they just friendly?

Detractor Strategy: Decide whether to engage, neutralize, or route around detractors

Forecasting: A map makes pipeline reviews grounded. “We’re close” means less without showing the influence web

A Tale of Two Deals

The Win

Recently one of my coaching clients engaged a global bank for a security solution. Our first assumption was that the CIO’s office held the decision. However, the influence map told another story: the COO held the purse, the risk director whispered in his ear, and the CISO’s technical team carried credibility but no budget.

By shifting strategy — building deposits with the COO around operational resilience and making the risk director feel like an insider — the client was able to build sufficient support to win the deal.

The Loss

On the flip side, another coaching client chased a large insurance company without fully mapping influence. While she had a great champion in IT, she spent little time fostering relationships with individuals in procurement and compliance. Months later, the deal died quietly in the hands of a compliance officer she’d never met.

The lesson? Every un-mapped influencer is a hidden risk.

Making a Game of Influence Mapping

Mapping influence isn’t just tactical. It’s mental. It requires:

Curiosity: Asking who else matters, even when you think you know

Humility: Accepting that your assumptions might be wrong

Patience: Building deposits over time, not forcing the deal

Detachment: Recognizing that some people won’t support you — and that’s okay

Without the right mindset, maps become static drawings. With the right approach, they become living strategy.

Influence Maps as Coaching Tools

For Managers

In pipeline reviews, ask: “Show me the influence map.”

Use maps to spot single-threaded risks early.

Coach reps on detractor engagement strategies.

For Enablement Professionals

Provide templates (org chart plus influence layer)

Coach reps on how to build the map

Teach reps how to color-code and annotate

Run role-play sessions: “Here’s your map — how do you win?”

When managers and enablement leaders insist on maps, it creates a culture where political acumen is as important as product knowledge.

Competitors Are Mapping Too

Here’s the uncomfortable truth: your competitor is also mapping influence. They’re making deposits into their RBAs with the same stakeholders. Sometimes they’ve been doing it longer.

This means two things:

You need to spot competitor influence early. Who mentions “we’re already talking to Vendor X”? That’s a red flag

You need to decide whether to flip a stakeholder, neutralize them, or outflank them

Winning isn’t just about building your map — it’s about disrupting the other side’s.

Metrics That Matter

How do you prove influence mapping works? Track these outcomes:

Win rate improvement on deals with maps vs. without

Cycle time reduction (mapped deals move faster)

Coverage health: number of functions and levels engaged per deal

Reduction in “no decision” outcomes.

Numbers give leaders confidence that this isn’t “soft skill work” — it’s pipeline protection.

Exercises You Can Run with Your Team

30-Minute Map Sprint

Each rep picks one live deal, sketches the map, and presents it. Teammates identify gaps: “Who in finance cares?” “Where’s legal?”

Detractor Role Play

Assign someone to play a red stakeholder. Rep has to win them over or neutralize them in a role-play call

RBA Overlay

Take the map and mark where you’ve made deposits. Where are you under-invested? Where are withdrawals overdue?

These exercises make mapping experiential rather than academic.

Action Plan

Here are five actions to take this week:

Pick your top opportunity and build a draft map

Validate it with your team — SEs, managers, partners and even coaches inside the target company

Identify one hidden influencer and plan outreach

Run a detractor play. What will it take to shift or neutralize them?

Block 10 minutes weekly to update your map

Conclusion: Clarity Over Chaos

In enterprise sales, the path to “yes” is never linear. It’s messy, political, and human. While influence maps don’t eliminate that mess, they do bring clarity. They make the invisible visible.

For me, influence maps are more than a tactic. They’re a way of reminding myself that deals are won by coalitions, not individuals. They connect directly to the Relationship Bank Account — guiding where to invest — and to a bigger game, demanding the mindset to stay curious, humble, and patient.

If you’re not mapping influence, you’re gambling. If you are, you’re orchestrating. And in enterprise sales, orchestration beats luck every time.

So grab a whiteboard, draw the map, and let the real selling begin.

No comments:

Post a Comment